| plant | mc | capacity_1 | capacity_2 |

|---|---|---|---|

| coal | 40 | 100 | 100 |

| gas | 60 | 100 | 100 |

| oil | 90 | 100 | 100 |

Economics of Battery Storage

Outline

- Review how a lack of storability shapes electricity market outcomes

- Consider how costs and prices would change with storage

- Ask whether storage helps or hurts renewables

- Consider the economics of private battery investment

Battery background

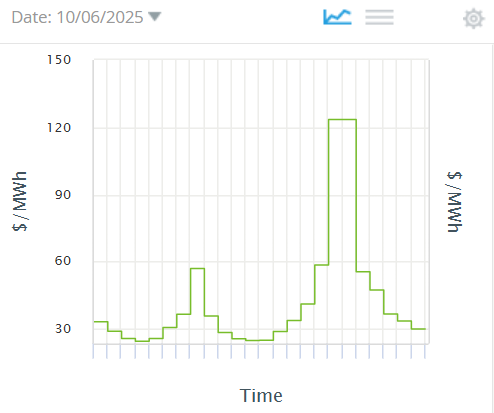

Electricity prices vary a lot over the day. Why?

Demand varies & electricity not storable

Requires us to produce using more expensive plants

Battery storage can help

- Batteries arbitrage price differences over time

- Charge the battery (buy power) when prices are low

- increases demand when prices are low, raising prices

- Discharge the battery (sell power) when prices are high

- increases supply when prices are high, lowering prices

Questions:

- Is this good for consumers?

- What about producers?

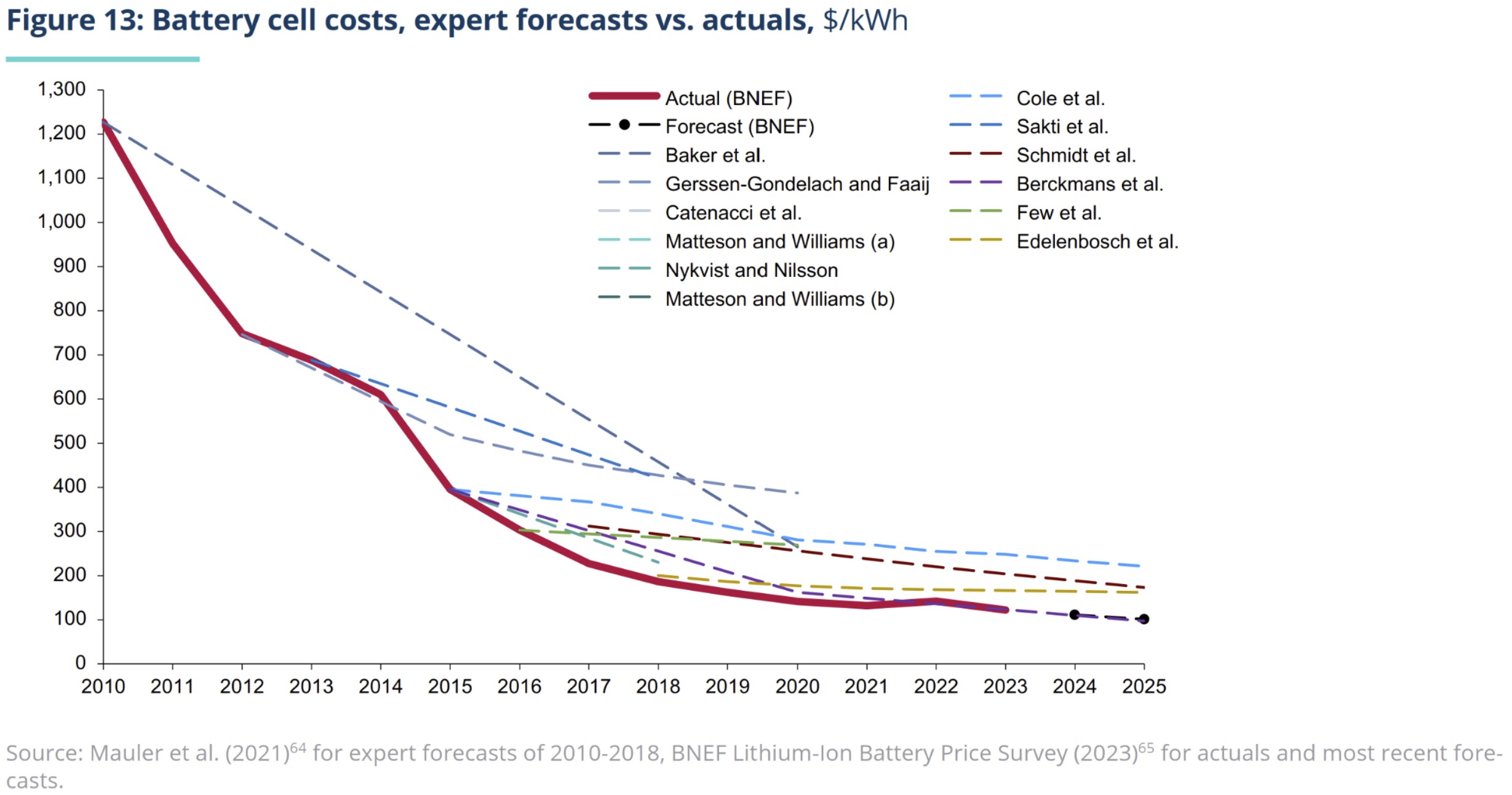

Why are we talking about this now?

Battery numerical example

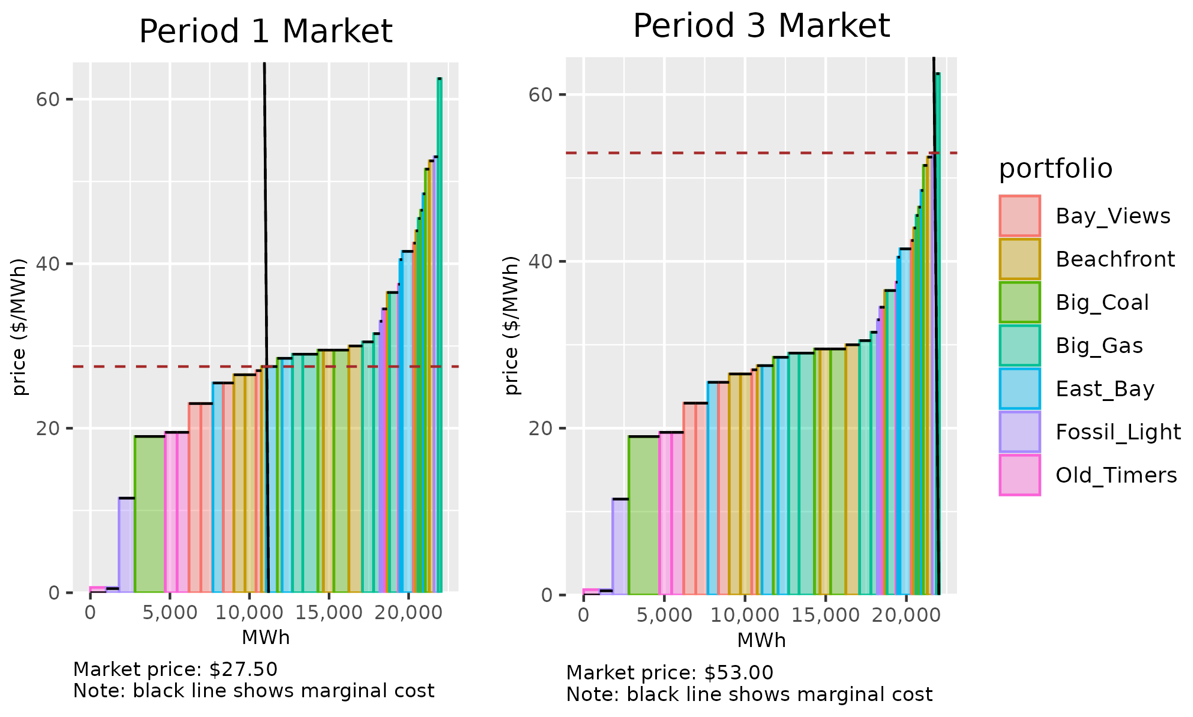

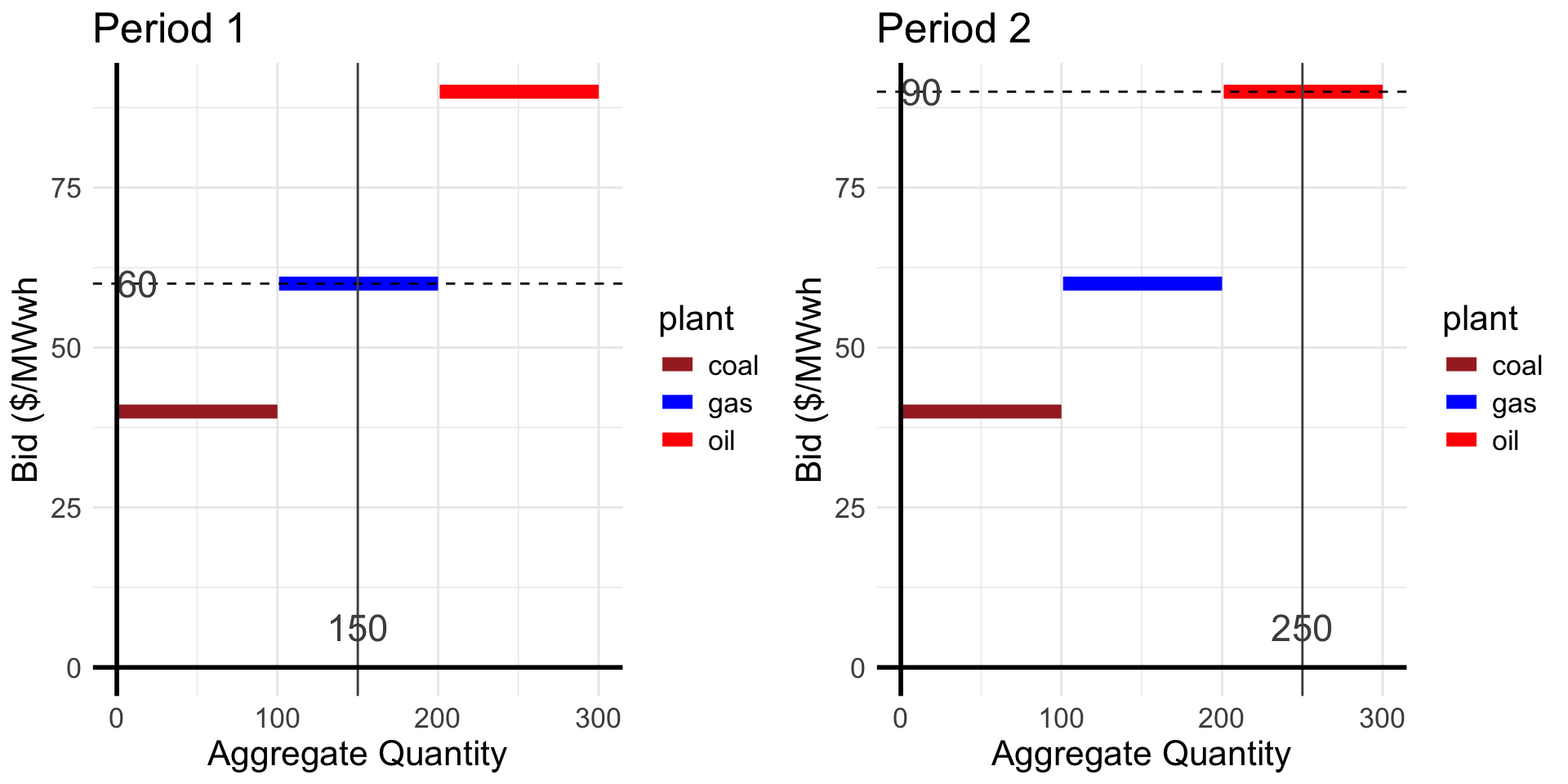

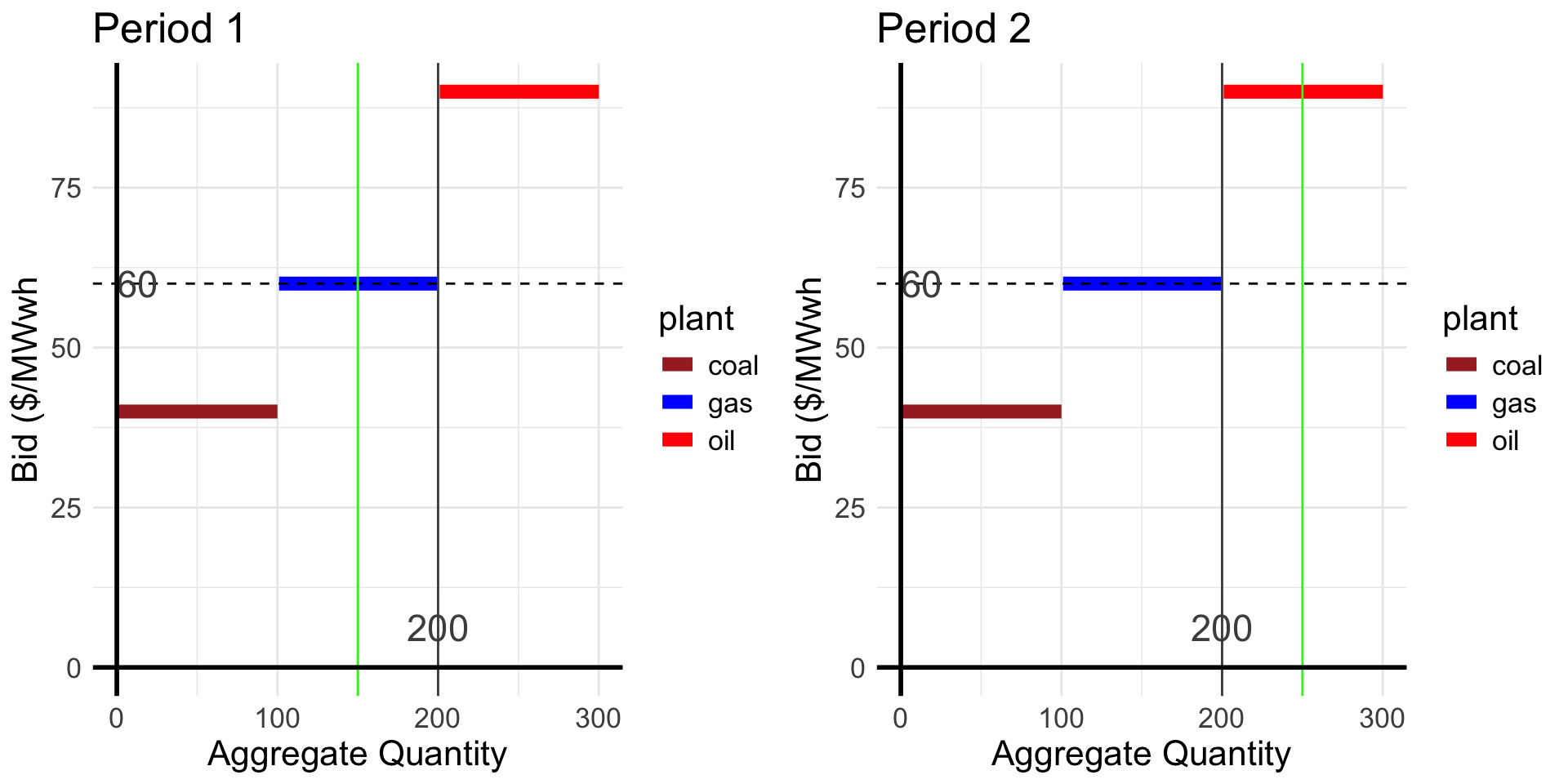

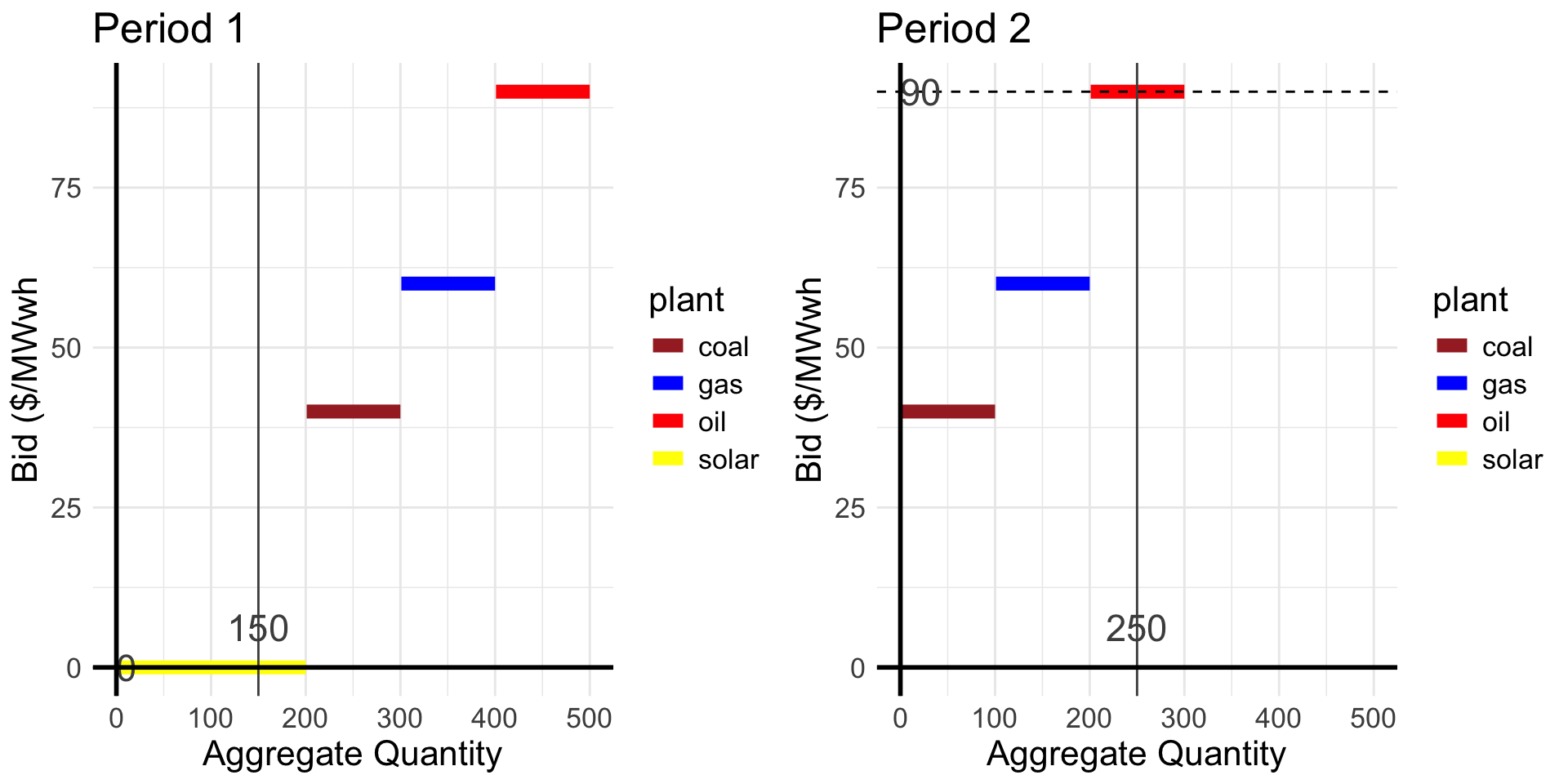

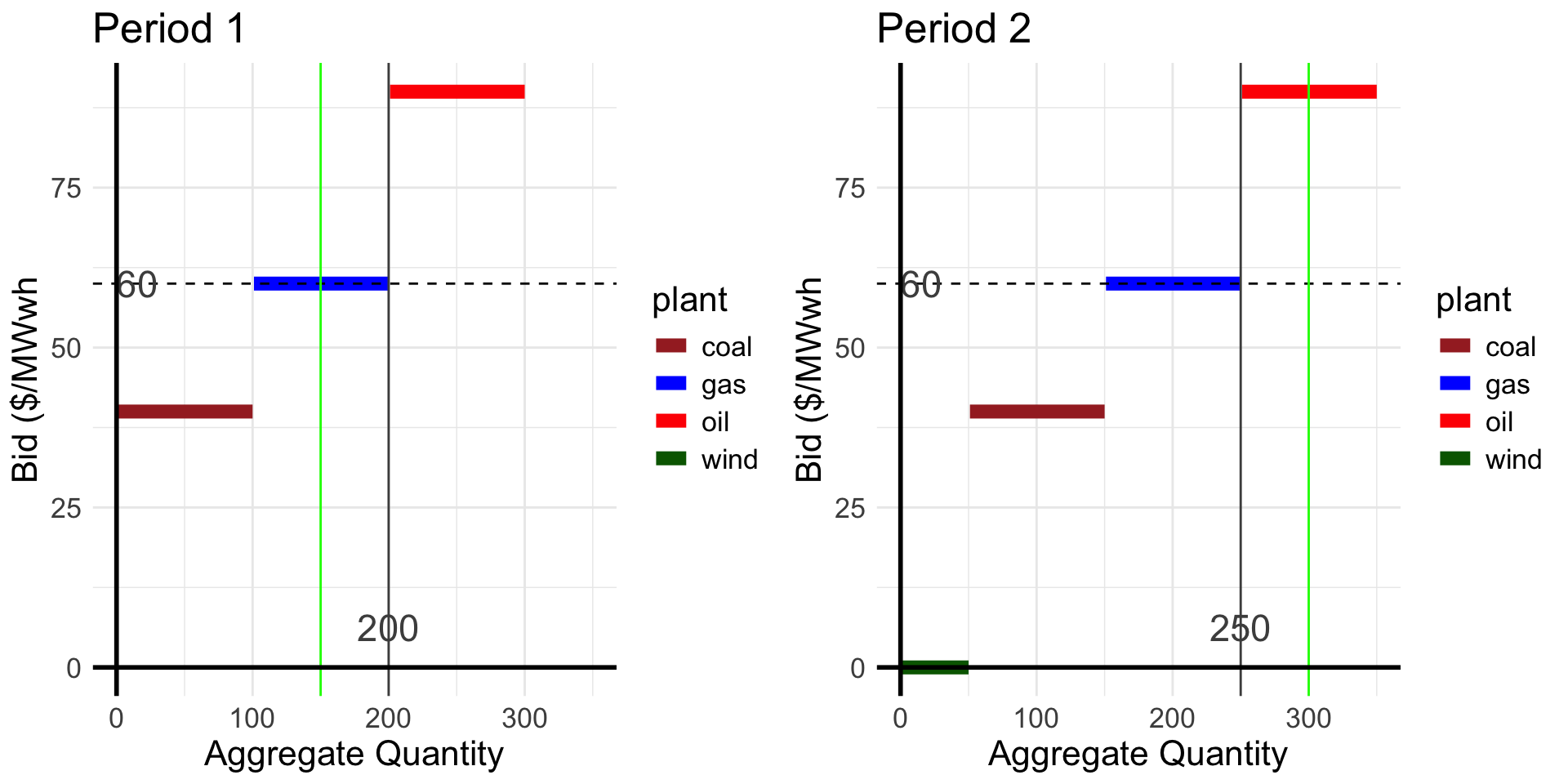

Consider a simple two period market

If demand is 150 in period 1, and 250 period 2, what will the prices be?

Baseline outcomes (no storage)

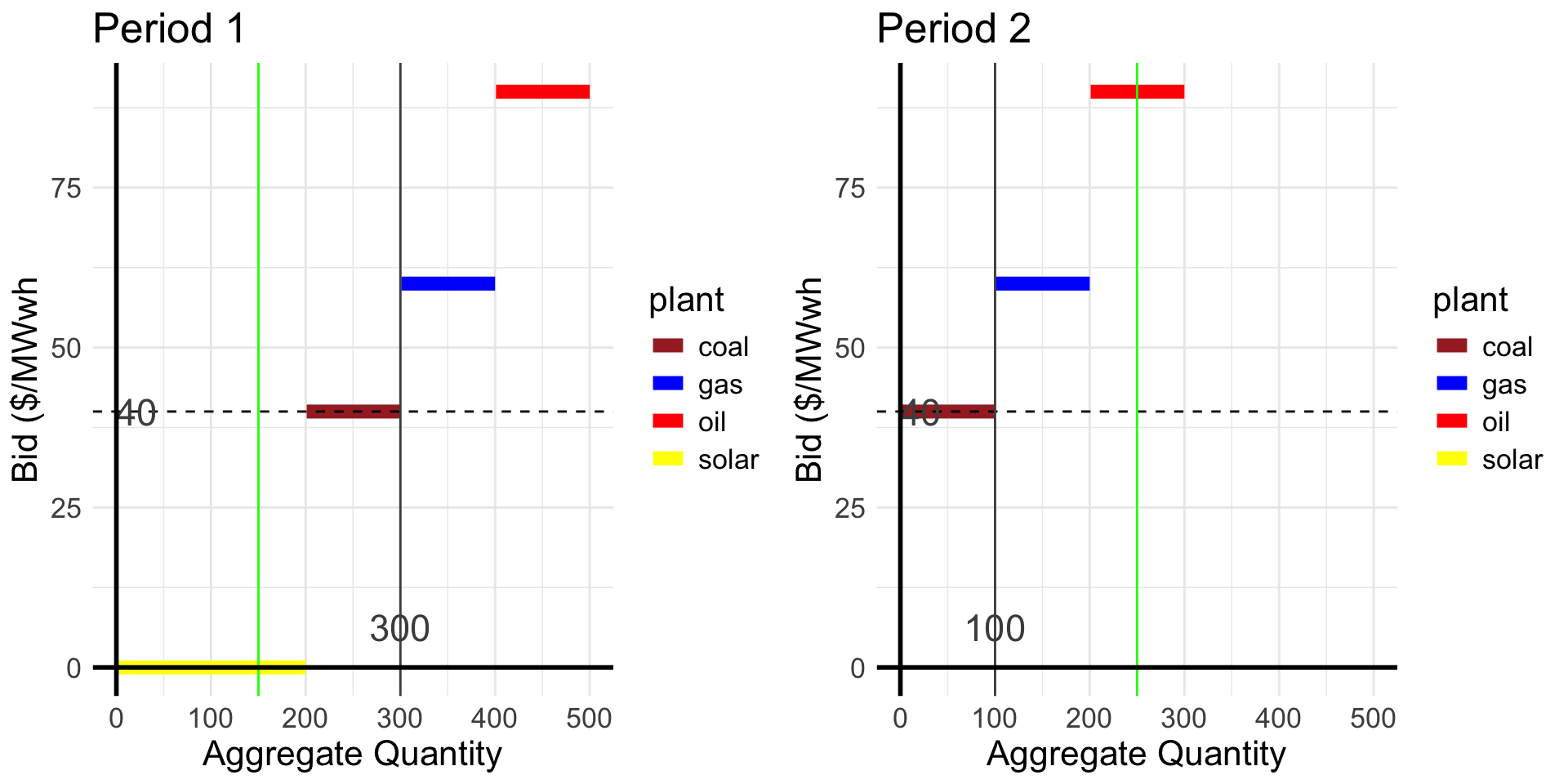

How much would a battery charge?

Outcomes with (unlimited) battery storage

How much did total consumer costs change?

Are producers better or worse off?

| plant | case | prod | avgP | profit |

|---|---|---|---|---|

| coal | baseline | 200 | 75 | 7000 |

| coal | storage | 200 | 60 | 4000 |

| gas | baseline | 150 | 80 | 3000 |

| gas | storage | 200 | 60 | 0 |

| oil | baseline | 50 | 90 | 0 |

| oil | storage | 0 | 0 | 0 |

Steps for solving a 2-period battery problem

- Find the baseline prices and quantities without storage

- Arrange plants in order of increasing marginal cost.

- Marginal cost of the marginal plant sets the price

- Check if arbitrage is profitable

- If prices are not equal, could make money by buying low and selling high.

- Increase demand in the low-price period and decrease demand in the high-price period, until prices are equalized.

- If the battery has a limited capacity, check that this doesn’t exceed capacity.

- If it does, then the capacity will be reached and prices may not be equal.

Renewables

Main limit to renewable adoption is “availability” not cost

In some places we have “too much” solar (during the day)

Watch this video on the “Duck curve”

Problem getting worse over time

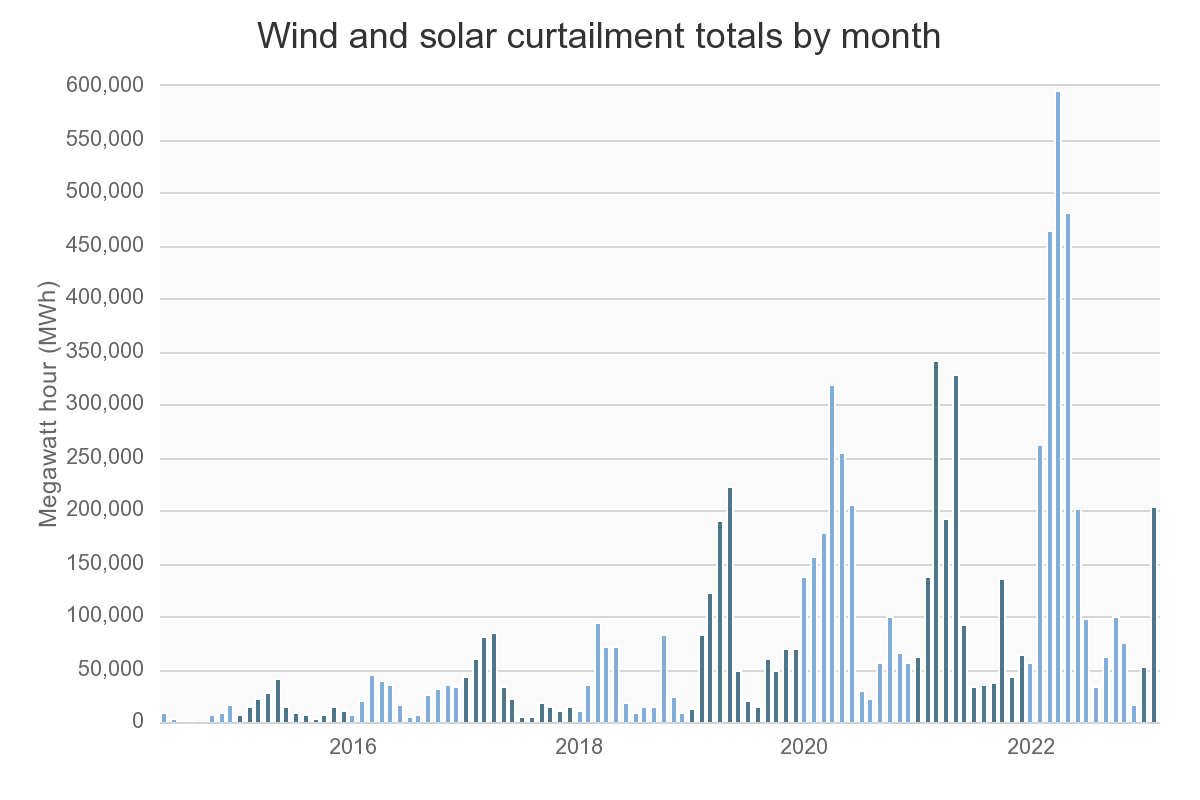

We actually “throw away” a lot of renewables

CAISO curtailment (Source: Meredith Fowlie)

Would batteries operating through arbitrage help solar?

- When do you think wholesale prices are highest? Does it correlate with solar production?

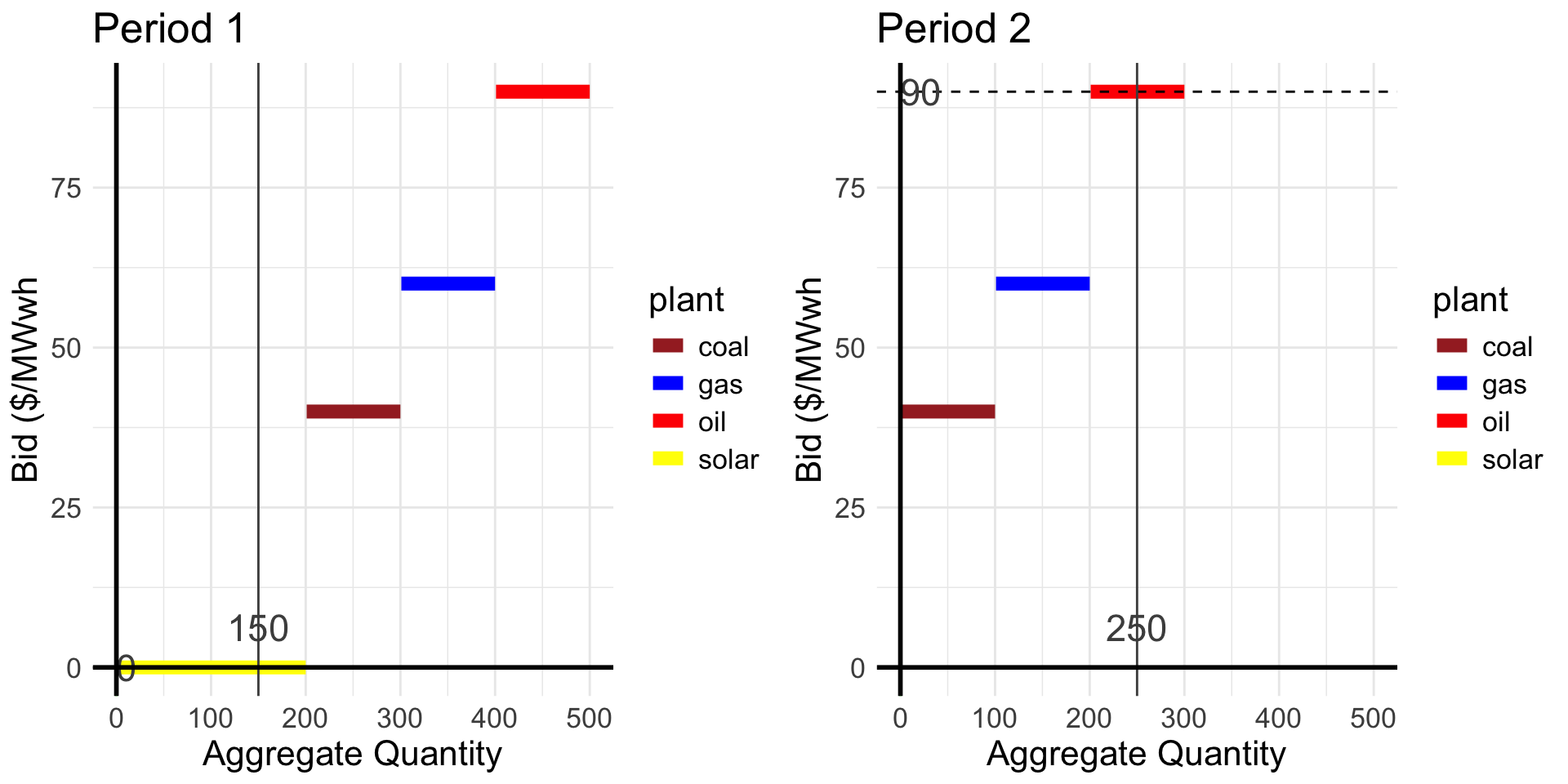

Let’s add solar to the 2-period model

Solar only able to produce in period 1 (off-peak)

| plant | mc | capacity_1 | capacity_2 |

|---|---|---|---|

| solar | 0 | 200 | 0 |

| coal | 40 | 100 | 100 |

| gas | 60 | 100 | 100 |

| oil | 90 | 100 | 100 |

If demand is 150 in period 1, and 250 period 2, what will the prices be?

Baseline outcomes (no storage)

How much profit is solar earning here?

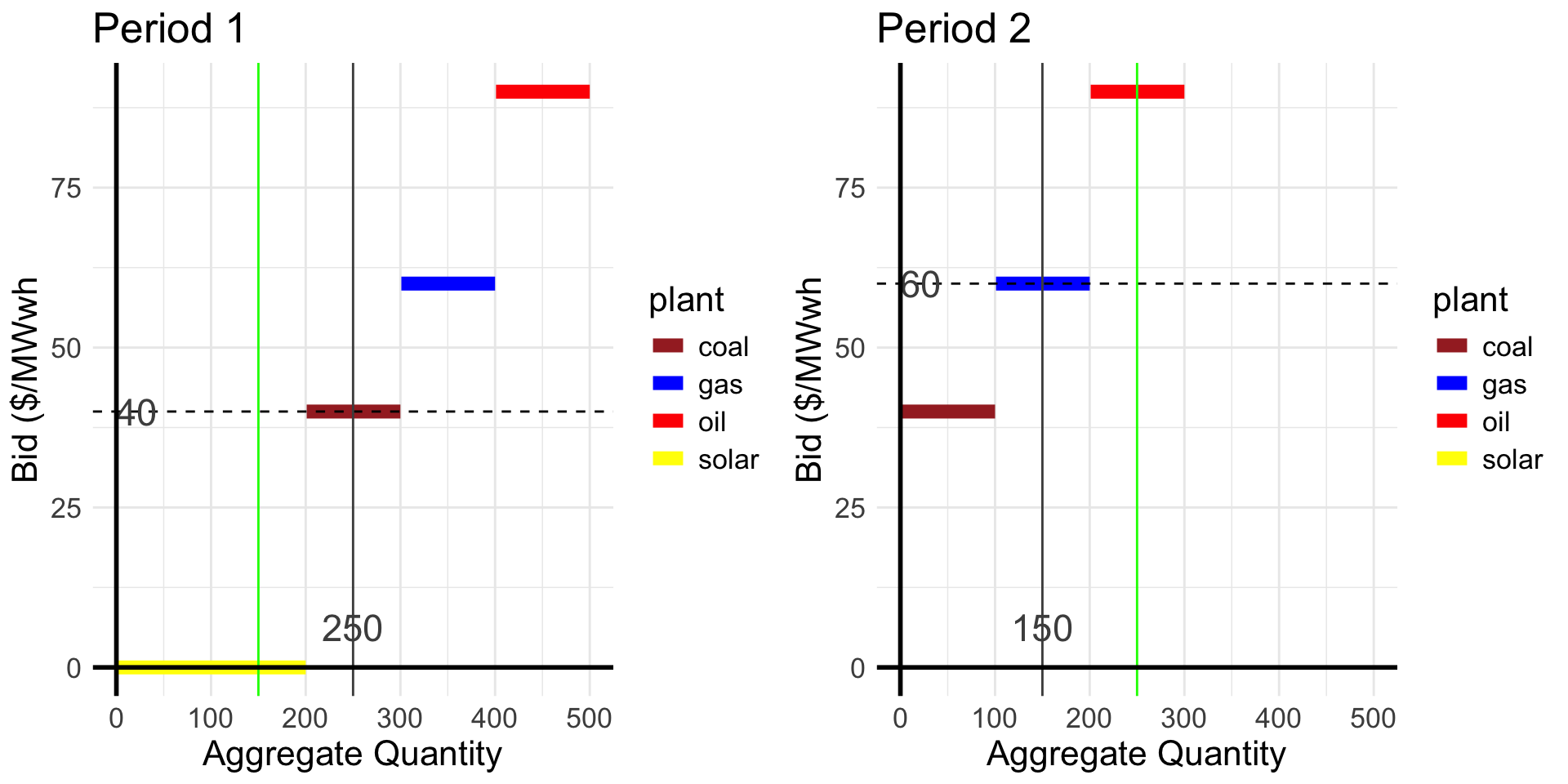

What would a 200 MW battery do to this market?

Outcomes with (unlimited) battery storage

How much profit is solar earning now?

Profits with and without storage

| plant | case | prod | avgP | profit |

|---|---|---|---|---|

| coal | baseline | 100 | 90 | 5000 |

| coal | storage | 200 | 40 | 0 |

| gas | baseline | 100 | 90 | 3000 |

| gas | storage | 0 | 0 | 0 |

| oil | baseline | 50 | 90 | 0 |

| oil | storage | 0 | 0 | 0 |

| solar | baseline | 150 | 0 | 0 |

| solar | storage | 200 | 40 | 8000 |

Are batteries worth investing in?

- Imagine batteries are independently owned and operated.

- Owners pay a fixed cost (per capacity)

- They earn money buy buying low and selling high

- How much operating profit does the battery earn in this example?

| capacity | stored_Q | price_1 | price_2 | profit |

|---|---|---|---|---|

| 200 | 150 | 40 | 40 | 0 |

What if battery capacity was only 100 MW?

Battery profits with 100 MW capacity

| capacity | stored_Q | price_1 | price_2 | profit |

|---|---|---|---|---|

| 100 | 100 | 40 | 60 | 2000 |

So it might make sense to invest in enough batteries to store all solar power, but not coal.

Are batteries necessarily good for renewables?

- In this example, batteries are good for solar, because the market price is negatively correlated with solar availability

- Either because of solar or because demand is higher in other periods

- This doesn’t necessarily have to be true

- On some days, AC demand might reverse that

- Another important example is wind: In many locations, its windier when the sun goes down.

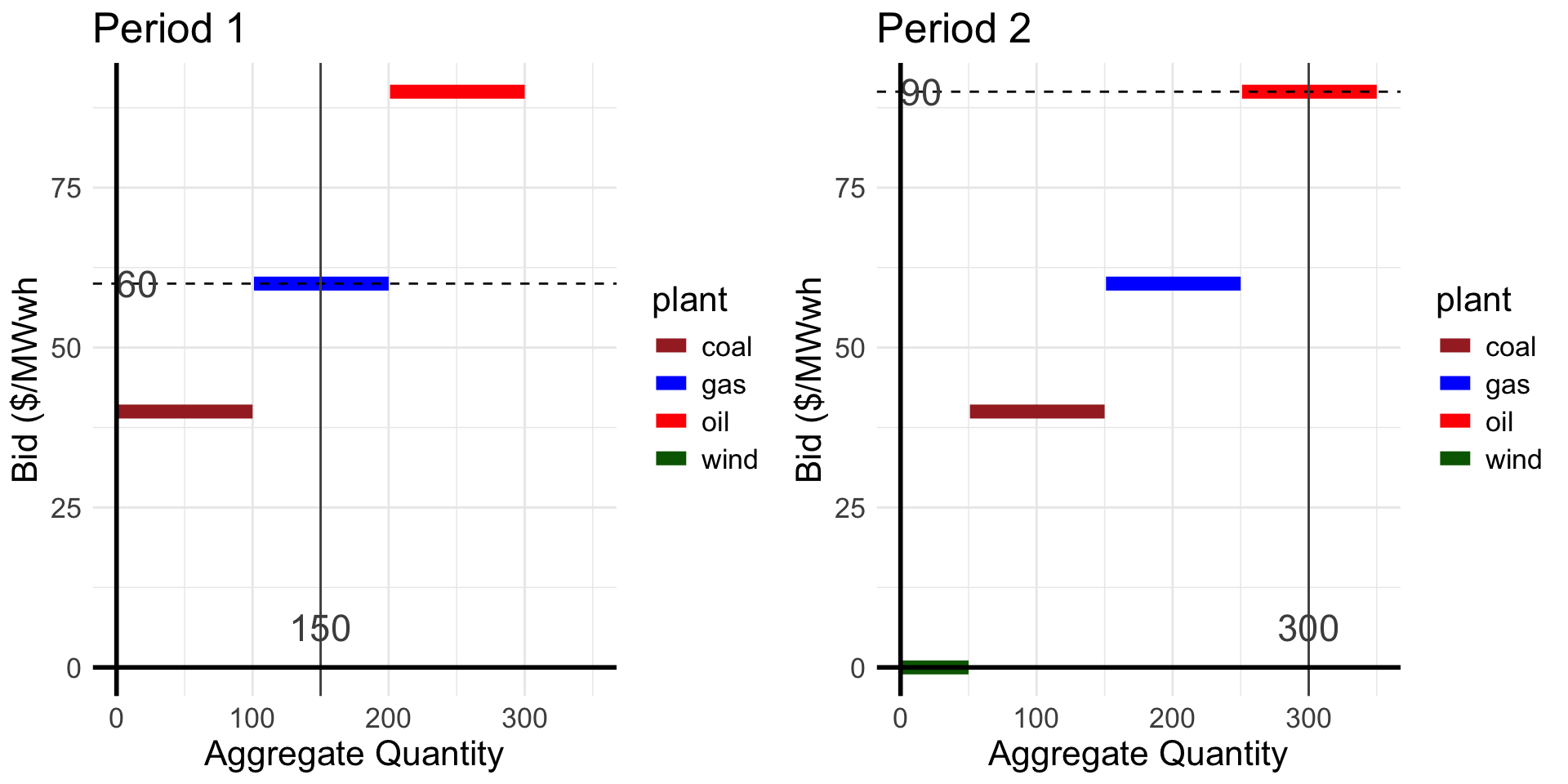

Consider a market with 50 MW wind instead

Opposite of solar: wind only produces in period 2 (peak)

| plant | mc | capacity_1 | capacity_2 |

|---|---|---|---|

| wind | 0 | 0 | 50 |

| coal | 40 | 100 | 100 |

| gas | 60 | 100 | 100 |

| oil | 90 | 100 | 100 |

If demand is 150 in period 1, and 300 period 2, what will the prices be?

Baseline outcomes (no storage)

How much profit is wind earning here?

Wind outcomes with (unlimited) battery storage

How much profit is wind earning now?

Profits with and without storage

| plant | case | prod | avgP | profit |

|---|---|---|---|---|

| coal | baseline | 200 | 75 | 7000 |

| coal | storage | 200 | 60 | 4000 |

| gas | baseline | 150 | 80 | 3000 |

| gas | storage | 200 | 60 | 0 |

| oil | baseline | 50 | 90 | 0 |

| oil | storage | 0 | 0 | 0 |

| wind | baseline | 50 | 90 | 4500 |

| wind | storage | 50 | 60 | 3000 |

Summary on Batteries

- The main limitation of renewables is that they are intermittent

- Batteries solve that problem by allowing battery owners to store power from renewables when prices are low and dispatch when prices are high

- Batteries must be paid for, so gains from this trade need to cover the fixed cost

- Whether batteries help or hurt renewables depends on the correlation between renewable availability and market prices

Econ 3391 - Batteries