Energy Efficiency

Intro

Lecture draws on:

Allcott and Greenstone (JEP 2012) Allcott (Annual Review 2014) Gerarden, Newell and Stavins (JEL 2018)

Energy services require capital

Source: Allcott and Greenstone (2012)

Long standing assertion that energy efficient capital suboptimally deployed

-

Serious interest began during oil crisis in 1970s

-

Engineers concluded that many energy saving technologies were slow to diffuse

- for example Amory Lovins and RMI

Over time interest has centered on apparent “win-win” from environmental perspective

- Energy consumption associated with many externalities

40 years later this view still has a large audience

There are many “rational” reasons for EE gap

- agency issues

- ie landlord tenant

- resale issues

- home improvements

- engineering models wrong

- Fowlie, Greenstone and Wolfram (QJE 2018)

Research focussed on “behavioral” explanations

- [present bias]

- tradeoff is over cash flows not consumption

- car or mortgage payments also flows

- firm mispricing problem less clear

- car companies don’t sell you gasoline

- tradeoff is over cash flows not consumption

- inattention/ salience

- Chetty et al (2009); Hossain \& Morgan (2006)

- cognitive issues /confusion

- Abaluck \& Gruber (2011); Allcott (2013)

Setup

Consumers have indirect utility \(u_{j} = \eta (y - p_j - \gamma g_j) + \nu_j\)

- $p_j$ is upfront cost

- $\nu_j$ is the usage utility

- $g_j$ is the lifetime energy cost

Assuming $g$ is calculated and discounted appropriately, a natural test is to estimate $\gamma$ and test if its equal to 1.

Lifetime energy costs

\[g_{j} = \sum\limits_{t=0}^{T} \delta^t m(r_j,e_t)r_j e_t\]- $m$ is utilization

- $r_j$ is energy requirement for capital $j$

- $e$ is the energy price

Note

- $\delta, m, T, e$ could all have $i$ subscripts

- if $m$ is endogenous, can lead to a “rebound effect”

Early literature tried to estimate $\delta_i$

Hausman (1979) estimates a discrete choice model for AC’s

\[u_{ij} = \eta (y_i - p_j - \delta_i \bar m_i r_j e_t) + \alpha X_j + \epsilon_{ij}\]- Has a small survey of households with submetered ACs

Literature then turned to within product variation

- In the cross section, concern that $E[r_j \epsilon_j] \ne 0$

However, $g_{ij}$ varies for many other reasons within product

- energy prices vary

- across regions, time

- lifetime varies at time of sale

- Sallee et al. look at mileage

Allcott and Wozny

- What’s the research question?

- What’s the empirical strategy?

- What data do they have?

AW cost to own

\(p_{j} + \sum\limits_{t=0}^{T} \delta^t m(r_j,e_t)r_j e_t\)

- used car auction vehicle prices from Manhiem

- what are the assumptions using this?

- assumed real discount rate of 6%

- vehicle loan rate 6.9%

- S\&P avg return 5.9%

- (exogenous) VMT ($m$) and $T$ from NHTSA

- fuel economy from EPA

- national avg gasoline prices / oil futures

Controlling for product quality clearly matters

Identifying variation

AW use hedonic regression

Typical logit share identity (Berry, 1994): \(\ln s_{jat} - \ln s_{ot} = -\eta (p_{jat} - \gamma g_{jat}) + \psi_{ja} + \tilde \xi_{jat}\)

AW actually estimate: \(p_{jat} = - \gamma g_{jat} + \tau_t + \psi_{ja} + \epsilon_{jat}\)

Why do they do this?

Berry equation rearranged is \(p_{jat} = - \gamma g_{jat} - \frac{1}{\eta}(\ln s_{jat} - \ln s_{ot} ) + \psi_{ja} + \tilde \xi_{jat}\)

- The don’t have shares.

- Absorb $s_{ot}$ with time FEs.

- Put product FEs in $\psi_{ja}$

- $\xi$ and the remaining share difference in the $\epsilon$

\(p_{jat} = - \gamma g_{jat} + \tau_t + \psi_{ja} + \epsilon_{jat}\)

- So this tests it tests whether relative vehicle prices move one-for-one with changes in the relative gasoline costs.

- Coeff of interest $\gamma$ recovered with OLS.

AW also using a grouping estimator

-

group all cars by month, above / below median

- $Z_{jat}^u = 1(f_{ja} > f^{50}) \times 1(t=u$)

-

instrument for $G$ with $Z$

-

why do they do this?

Jerry Hausman’s (2001) “iron law of econometrics”: due to measurement error, the magnitude of a parameter estimate is usually smaller in absolute value than expected

What is the null hypothesis that AW want to test?

\[p_{jat} = - \gamma g_{jat} + \tau_t + \psi_{ja} + \epsilon_{jat}\]Visual results

AW Results - Sensitivity

What do people takeaway from this paper?

- tradeoff implies discount rate of about 15%

- for new cars, close to 1

- old cars, very low

-

results sensitive to how G is constructed

-

are people making mistakes?

- what questions does this leave open?

Allcott and Knittel

Recent emphasis has been on experiments

-

Many studies similar to AW

-

Although panel data helps, interpretation still requires econometrician to construct $g$

-

If hypothesis is that $\gamma < 1$ due to inattention, imperfect information or bounded rationality, an alternative is to experimentally vary exactly those margins

Alternative: AK 2019 conduct two large field experiments

Experiment #1:

- Hang out at car dealers and intercept potential buyers

- Randomly explain fuel economy savings to some

Experiment #2:

- Conduct and online survey of people how say they are in the market for a new car

- In addition to following up on what people actually bought, AK elicit WTP for fuel economy.

Some advantages of surveys

-

can ask people about consideration sets

-

can ask about beliefs

-

can elicit WTP

Consideration sets reveal important differences

Beliefs about fuel costs noisy, but not biased

Results

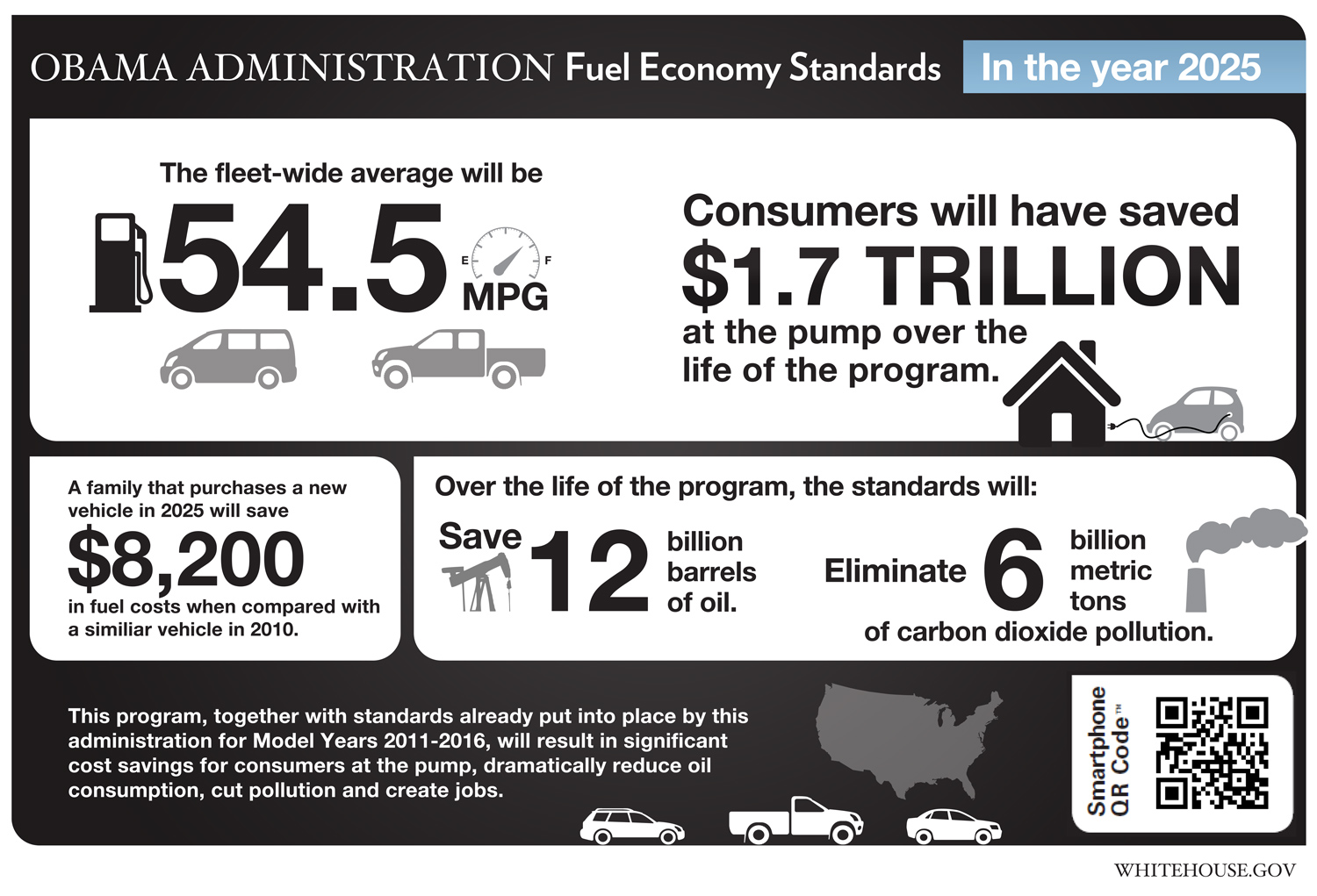

Policy Implications

Some conclusions from core EE gap lit

-

assertion that consumers making large mistakes on average appears incorrect

-

once you account for product unobservables and use exogenous fuel cost variation, tradeoffs seem close to rational

-

experimental studies directly educating or directing consumer attention to energy costs have found very small impacts

Future directions

- Heterogeneity in both values and bias

- policy implications

- targeting

- What role do firms play here?

- Are they offering the “right” set of products?

- How do consumer’s form beliefs?

- we know the true calculation is hard

- rational inattention (Sallee JLE 2014)

- we know the true calculation is hard

Allcott and Taubinsky

Can policymakers improve welfare in this market?

-

develop a theoretical framework in presence of heterogenous bias and tastes

-

implement two experiments informing consumers about CFLs

-

evaluate welfare effects:

- optimal subsidy

- [ban on incandescents]

Corrective taxation with damage heterogeneity

Pigou (1920):

\(\tau = D'(e)\)

If damages are heterogenous, first best achieved with polluter specific tax

\[\tau_i = D_i'(e_i)\]Diamond (BJE 1973): If damages are heterogeneous, but you can only set one tax rate, it should be equal to the average damages at the margin when the tax is implemented.

\[\tau_h = E_i[ D'_i(e_i(\tau_h))]\]AT show this also applies to correcting biases

Setup

- unit demand: $j \in {E,I}$

- no outside option

- utility: $u_j = v_j + z - P_j$

- where $z$ is the consumer’s budget

- choose $E$ if $v - b > p$

- $v = v_E - v_I$

- $b$ is bias

Demand with and without bias

Welfare effect of subsidy

\[W(s) = Z(s) + v_I - p_I + \int_{v-b \ge p}(v - p) dF dG\]- perfect competition: $p = c - s$

Proposition 1:

\[W'(s) = (s - B(p)) D'_B(p)\]| where $B = E(b | v - b = p)$ is the average marginal bias – ie the average bias for consumers on the margin the (subsidized) price |

Optimal subsidy: \(s^* = B(c - s^*)\)

Average Marginal Bias

AMB is the key object of policy interest

Need not be constant

- Average marginal bias $\ne$ average bias

How can we estimate the average marginal bias?

Option 1:

- use within consumer variation in informedness

Option 2:

- estimate demand elasticity wrt tax and information

- calibrate difference

TESS experiment

-

Artefactual field experiment

-

Give consumers $10

-

Elicit WTP ($v$) for CFLs

-

Inform some consumers about cost to own to recover $b$

Many papers have used TESS

Informed vs uninformed demand

Average marginal bias not constant

Welfare effects

Welfare effects

Allcott, Knittel and Taubinsky

Extend AT model to allow correlation in bias and valuation

- consumers of type $j$ have distortions $d$ (nests bias from AT)

- value $v - d$

-

population average $\bar d = \sum \alpha_j d_j$

- define targeting as:

\(\tau (s) \equiv cov ( d_j, -Q'_j(c-s) )\)

- so a high $\tau(s)$ is well “targetted”

Welfare and optimal subsidy

Result 1: Poor targeting reduces welfare gains

\[W'(s) = (s - \bar d) \cdot D'(c-s) + \tau(s)\]Result 2: Optimal poorly targeted subsidy could be small, even if average bias is large

\[s^* = \bar d - \frac{\tau(s)}{D'(c - s)}\][ Optimal subsidy increasing in $\tau(s)$ ]

Bias is correlated with observables

As is policy takeup

Where does this leave us?

-

Optimal subsidy depends on average marginal bias

-

Not sufficient to know bias and responsiveness separately: need to show biased consumers are actually the onces affected by the policy.

Allcott and Sweeney

What we did

- partner with major appliance retailer

- field experiment at call center

- customer information and rebates

- sales agent incentives

- audit phone calls to check compliance

- survey consumers

Some thoughts on running a field experiment

- getting institutional buy in was tough

- in end, partner lost interest

- compliance a big issue

- has implications for feasible policy too

Some agents much better than others

Survey reveals widespread confusion, but small bias

Main Results

Agents Target Scripts

What role do firms play in this?

-

Allcott & Sweeney: Sales agents can target. Can we leverage this somehow?

-

Houde (2014): firms bunch product characteristics around subsidy / label cutoffs

-

Houde (2018): labeling may further reduce average purchased quality